Funds in Focus

EdenTree Multi-Asset Fund Range

Multi-asset solutions with sustainability-characteristics

Our range of multi-asset funds offer our sustainable and responsible investment expertise to the adviser-led investment market.

Designed to support advisers, our portfolios provide investment solutions for the long-term and offer a diversified mix of assets designed to weather different market environments.

Our three risk-controlled solutions are actively managed, featuring a combination of equities, fixed income, and alternative investments, such as Real Estate Investment Trusts (REITs) and Listed Infrastructure, to meet a range of different risk objectives and investment goals.

Diversified multi-asset solutions

We take an active approach to the Asset Allocation of our multi-asset portfolios, applying both a strategic (long-term) and tactical (shorter-term) perspective and fully aligning these with the portfolios’ specific risk parameters.

Our three risk-controlled solutions are actively managed, featuring a combination of equities, fixed income, and alternative investments, such as Real Estate Investment Trusts (REITs) and Listed Infrastructure, to meet a range of different risk objectives and investment goals.

The value of an investment and the income from it can fall as well as rise as a result of market and currency fluctuations, you may not get back the amount you originally invested.

Investing for a better tomorrow

EdenTree is a Responsible and Sustainable investment manager with a strong heritage. We are proud to be part of the Benefact Group – a charity owned, international family of specialist financial services companies that give all available profits to charity and good causes.

EdenTree are dedicated to Responsible and Sustainable investing, having launched our first ethical fund in March 1988.

Launch Date

01/07/21

IA Sectors

Mixed Investment 20-60% Shares

for CautiousIA Sectors

Mixed Investment 40-85% Shares

for Balanced and Growth#bbe7f9

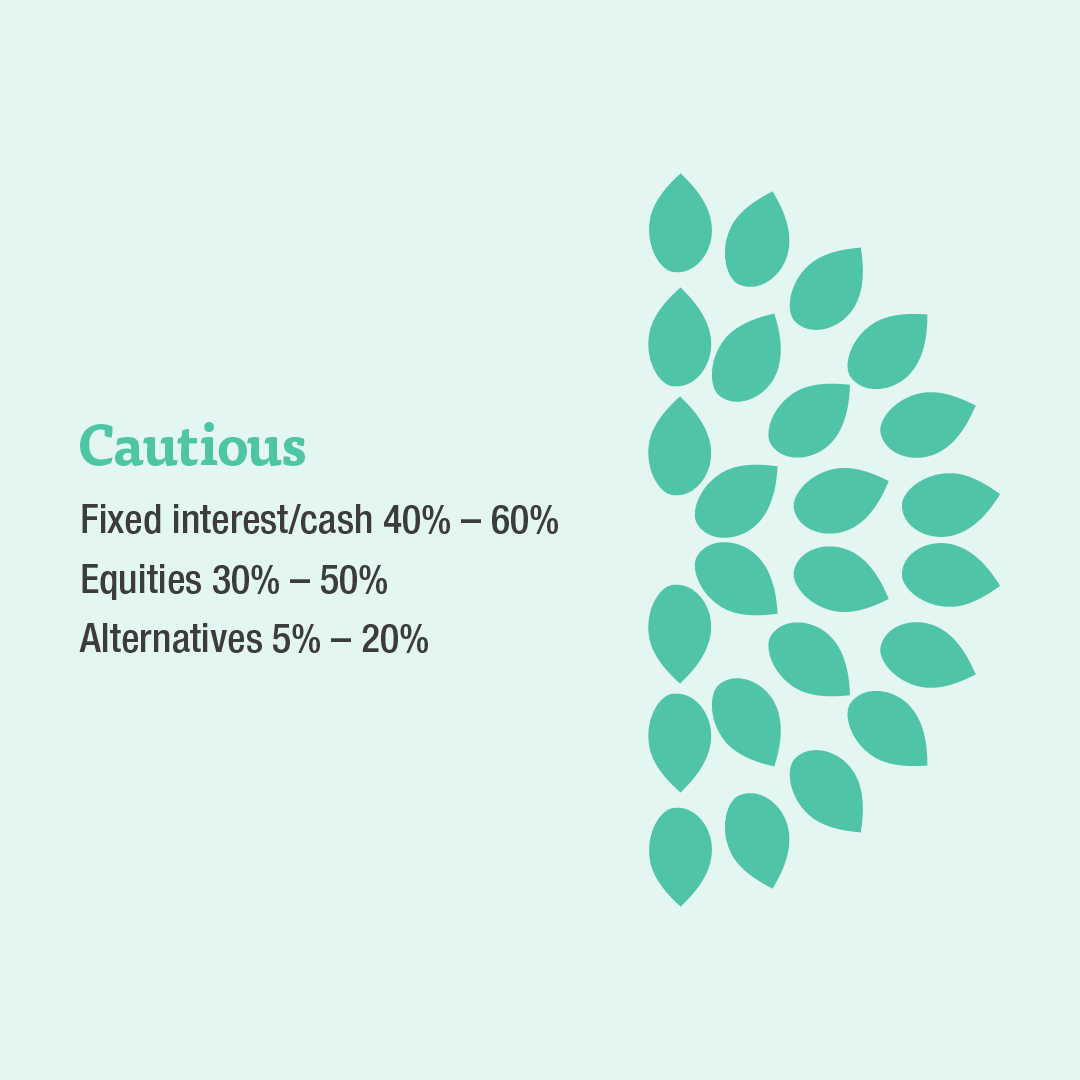

The Multi-Asset Cautious fund has a higher allocation to fixed income and a lower allocation to alternatives and equities. It seeks to provide long-term capital growth and income over five years or more with a lower level of risk relative to other funds within our range.

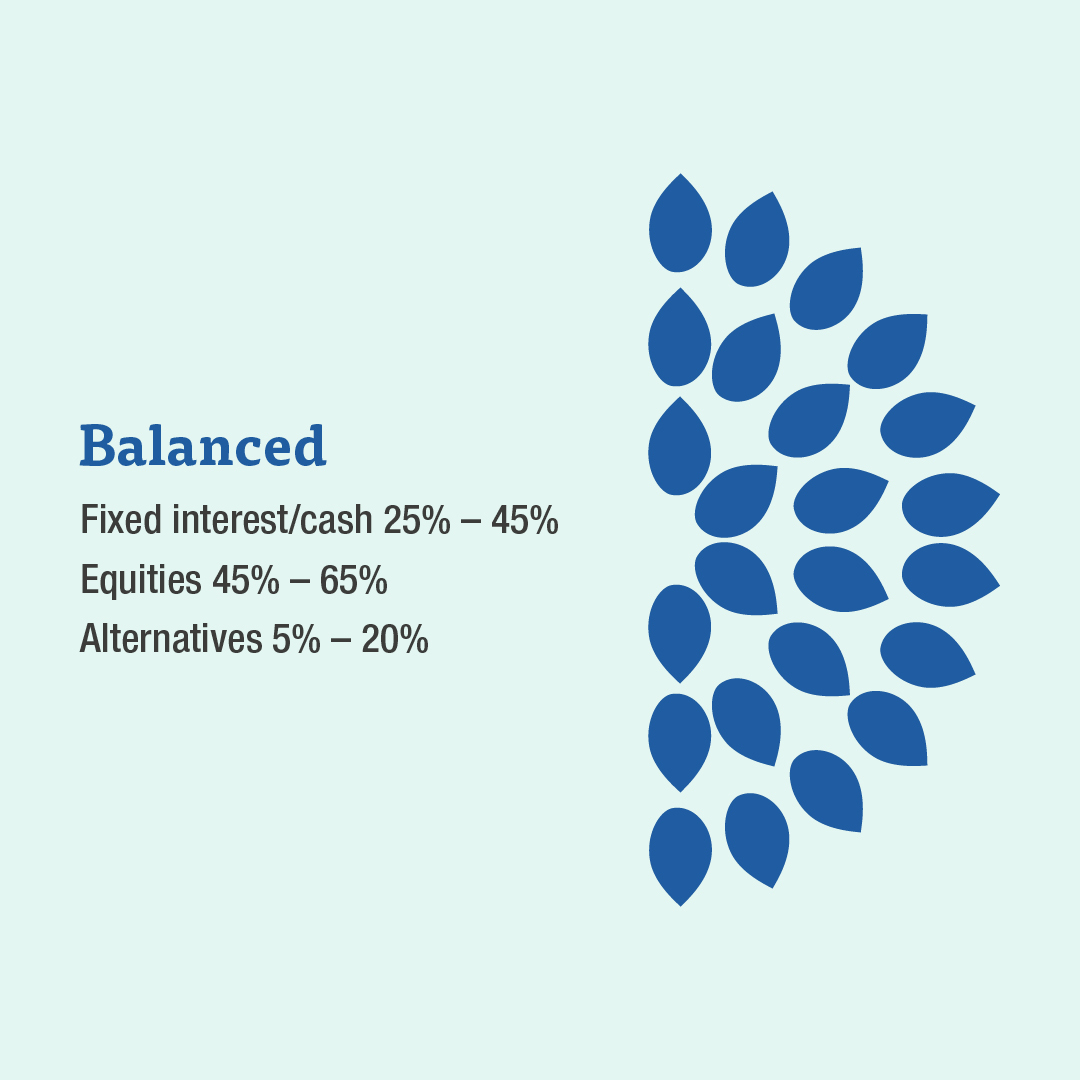

The Multi-Asset Balanced fund has a higher allocation to equities and a lower allocation to fixed interest and alternatives. It seeks to provide long-term capital growth and income over five years or more with a more moderate level of risk relative to other funds within our range

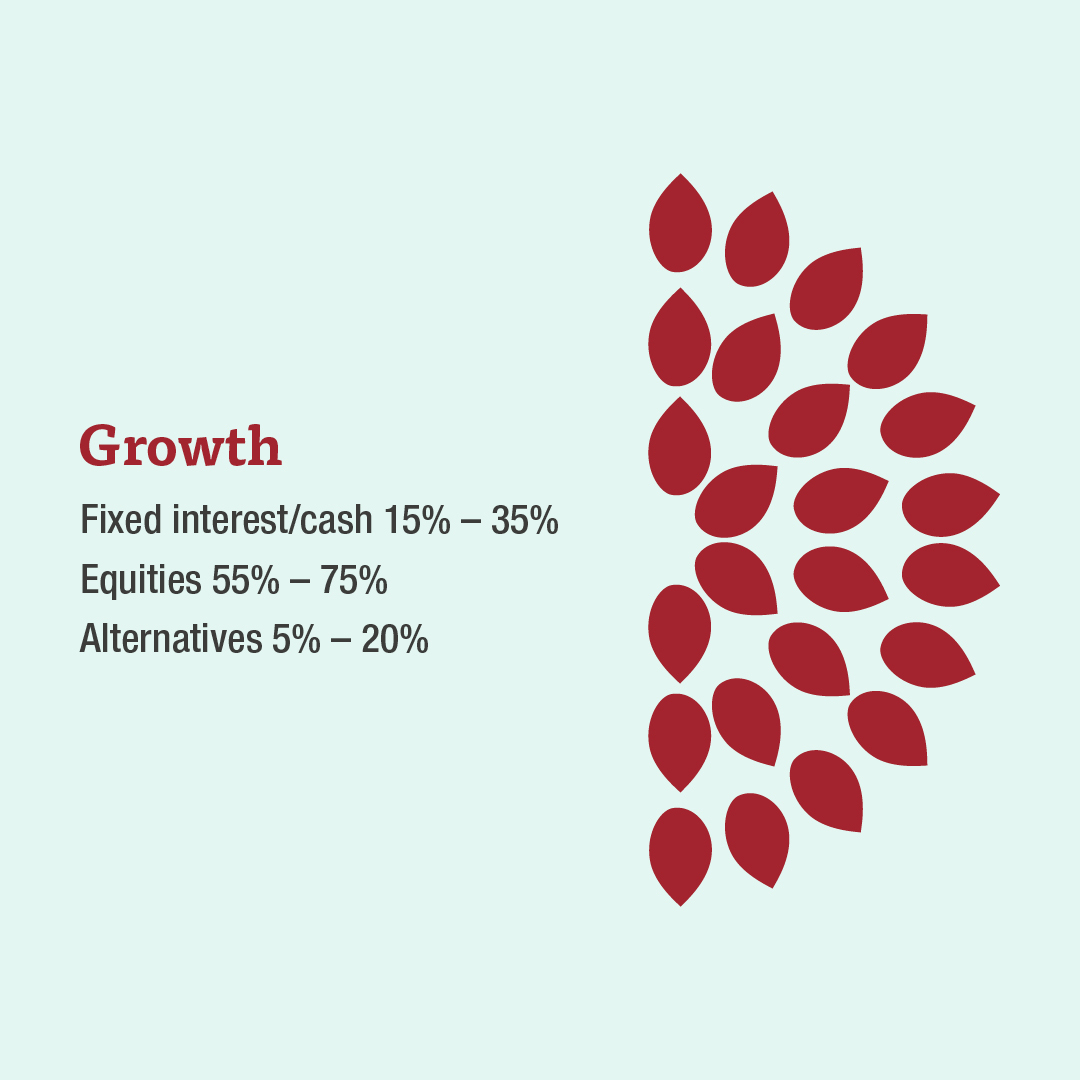

The Multi-Asset Growth fund has a high allocation to equities and a much lower allocation to fixed interest and alternatives. It seeks to provide long-term capital growth and income over five years or more with a higher level of risk relative to other funds within our range.

Fund manager

Chris Hiorns

Head of Multi-Asset Strategies & European Equities

Chris Hiorns joined EdenTree in 1996 and has been running responsible and sustainable money since 2008. Chris is EdenTree’s Head of Multi-Asset and European Equities. Chris holds an MSc in Economics from University College London and is a CFA Charterholder.

FUND LITERATURE

- EdenTree Multi-Asset Balanced Fund - Sustainability Disclosure

- EdenTree Multi-Asset Cautious Fund - Sustainability Disclosure

- EdenTree Multi-Asset Growth Fund - Sustainability Disclosure

- Factsheet - EdenTree Multi-Asset Cautious Fund A

- Factsheet - EdenTree Multi-Asset Cautious Fund B

- Factsheet - EdenTree Multi-Asset Growth Fund B

- Factsheet - EdenTree Multi-Asset Balanced Fund B

- Quarterly Report - EdenTree MAF Cautious Q1 2025

- Quarterly Report - EdenTree MAF Balanced Q1 2025

- Quarterly Report - EdenTree RS MAF Growth Q1 2025