This edition of the EdenTree CIO View is all about taking stock. In short:

- 2023 was a year of record-breaking temperatures with the global average climbing towards 1.5C over pre-industrial times; urgency was required but lacking at COP28 in Dubai

- More encouragingly, spending on clean energy and EVs continues to accelerate, providing real hope we have seen an inflection point for green investment

- We also consider the potential for positive feedback loops from the EU’s forthcoming carbon border tax and the outlook for green policy in the US in an election year

- We end with some reflections on SDR, a policy framework we plan to adopt across our fund range at the first opportunity

Every year starts with a moment of taking stock, assessing the year just gone, reflecting on what might transpire in the year ahead. Central bank policy, wars and AI enthusiasm dominated 2023, and in the case of the new conflict that has emerged in the

Middle East, has resulted in a deeply troubling humanitarian emergency and risk of regional escalation. Against that backdrop, the stock and bond market rally at the end of the year – driven by signs of a policy pivot from the Federal Reserve

and the relentless march of the so-called Magnificent Seven group of US mega-cap stocks – felt like one of relief more than anything else. Many column inches have been written about each, including in our recent round of quarterly commentaries.

Rather than repeat what has been written elsewhere from EdenTree, I plan to focus this newsletter on a stock take of a different sort, involving climate tipping points, COP28 and pivotal developments in the green revolution.

Extreme heat

Mark Twain’s quote “Climate is what we expect, weather is what we get” is often used to help explain the difference between climate change, which refers to long term meteorological patterns, and distinct weather events.

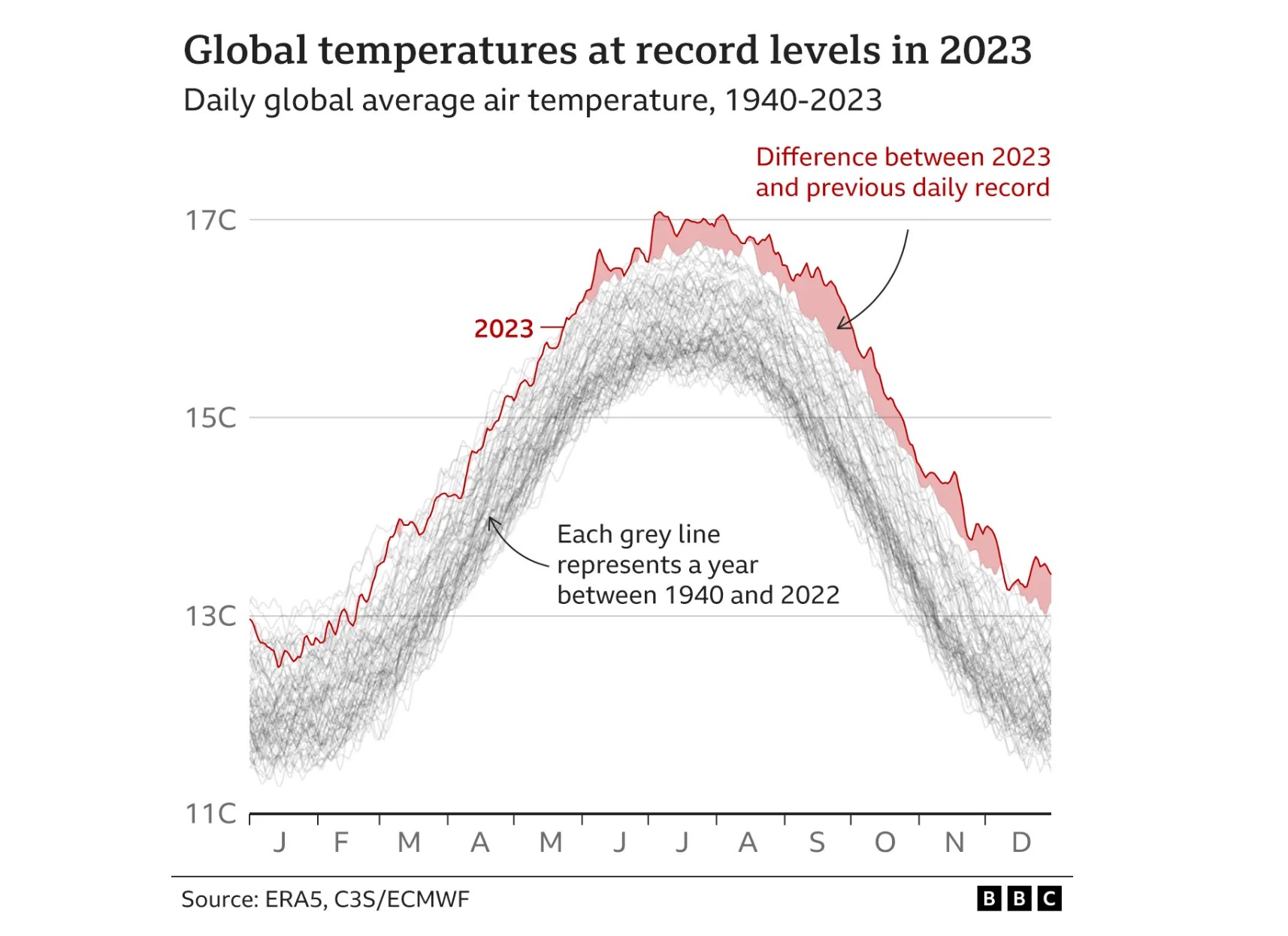

Worryingly, 2023 raised alarm bells among climate scientists about both assumptions in Twain’s quote. Last year was the hottest year since records began in 1850, with global average temperatures climbing to an average of 1.46oC above pre-industrial

times according to Met Office estimates1. The year produced a sequence of record-breaking monthly temperatures spanning from July, which were driven in part by the transition into El Niño. While this average appeared to be at “Paris

1.5C”, that threshold refers to longer term patterns rather than one year’s measure, but 2023’s average does reinforce the need for urgent agent to tackle the causes of climate change. Indeed, the extreme heat raised concerns

about Earth system tipping points, which were highlighted in a timely report from a team of over 200 climate scientists led by the Global Systems Institute at Exeter University2.

In terms of the weather, the world witnessed a series of broken records in terms of extremity. Mozambique and Madagascar suffered the brute force Cyclone Freddy, which lasted 37 days travelling across the south-west Indian Ocean and was the longest-lived

tropical cyclone ever recorded, at great human cost and causing damage of an estimated $665m. Beijing experienced its heaviest rainfall since records began, in the wake of Typhoon Doksuri. The Northern Hemisphere saw record summer heatwaves on land,

while sea-surface temperatures also hit record levels, with marine heatwaves in the Mediterranean and off the coast of the US during the summer months3. Indeed, global average daily sea surface temperatures hit 20.96C in the first week

of August, a new record. The oceans absorb 90% of the world’s heat4 and marine heatwaves are increasingly likely due to anthropogenic climate change, driving changes to precipitation patterns, melting sea ice (increasing sea levels

and affecting “albedo” – the Earth’s reflective power) and of course damaging coral reefs and aquatic life. Ocean heatwaves have material consequences for people’s livelihoods and wellbeing. A 2021 study estimated losses

of between US$800m and US$3.1bn in ecosystem services (including fisheries) following ocean heatwaves5.

COP28 falls flat…

Given global average temperatures were nudging 1.5C over pre-industrial times – the science-based goal that has been aspiration since COP21 in Paris in 2015 – you might be mistaken for expecting a no holds barred response to at the COP28 climate

summit in the United Arab Emirates (UAE) late in the year.

A key aim of the conference was to address the results of the first Global Stocktake (“GST”), a process built into the Paris Agreement whereby each country reports on progress since the 2015 accord. The GST was released ahead of the conference,

revealing a poor scorecard, with current collective efforts implying a temperature rise of 2.5C to 2.9C. Some of the recommendations from the report included: massively reducing greenhouse-gas emissions from 2019 levels – 43% by 2030, 60% by

2035 and 84% by 2050 – and massively scaling up renewables to meet the 1.5C goal; a significant increase in adaptation strategies; and some $5.9 trillion in climate finance by 2050 for countries most at risk due to climate change6.

We generally agree with the LSE’s assessment of the conference being “historic, but inadequate”7. COP28 acknowledged the urgency at the heart of these recommendations, and the final UAE Consensus took steps in the right direction.

Agreement on the Loss and Damage Fund, the inclusion of much-overdue wording about the need to transition away from fossil fuels, and the pledge to triple installed renewable energy capacity by 2030 were welcome steps. However, the final Consensus

was largely lacking in specific detail about how it would be achieved.

During a post COP28 briefing, Lord Nicholas Stern highlighted that a lack of investment has been a key impediment to meaningful progress in keeping on track to meet the Paris goals: “The global stocktake showed over this decade we might not reduce

emission by much at all when we actually need about 40% reduction to meet 1.5C. Why was this so bad? Because we haven’t invested enough in the new and clean to run down the old.”8 Stern went on to say that $2.4tn a year is required

by 2030 for developing economies (ex-China) to finance the energy transition, adaptation and loss and damage, coming from public and private sector sources.

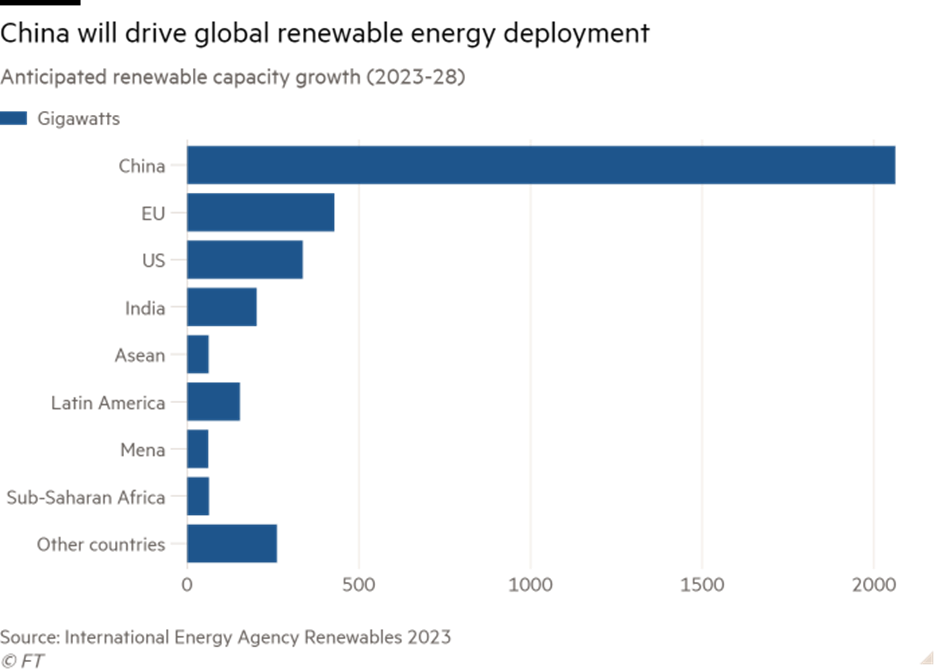

Meanwhile, the IEA suggests that 21% higher growth will be required to meet the COP28 target of tripling installed capacity by 2030 (i.e. to 11,000GW). Moreover, the IEA highlighted further hurdles that would need to be addressed to meet that goal, many

of which we’ve written about as a team here at EdenTree, including improvements to grid infrastructure, reduced administrative barriers and increased capital investment, especially in developing economies.

…and the SDGs are falling short

Of further concern, last year’s multi-agency report United in Science 2023 provided a stark assessment of the general lack of progress toward achieving the UN SDGs. At the halfway point of trying to achieve the 2030 goals, only 15% of the SDGs are

on track9, with climate change, in particular, cited as a key impediment to progress on each of the 17 goals.

But there are reasons for optimism

Combine these headlines with the daily barrage of bad news from Ukraine and the Middle East, and it is easy to become despondent. However, when it comes to investment in the green revolution, there are reasons for optimism.

Have we reached a green investment tipping point?

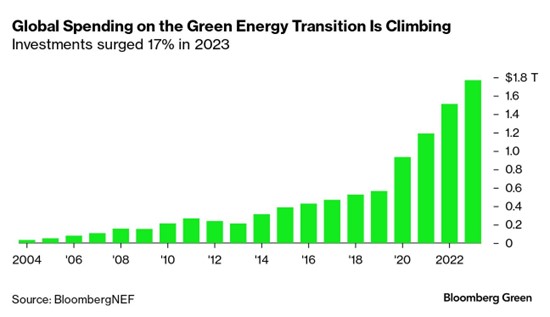

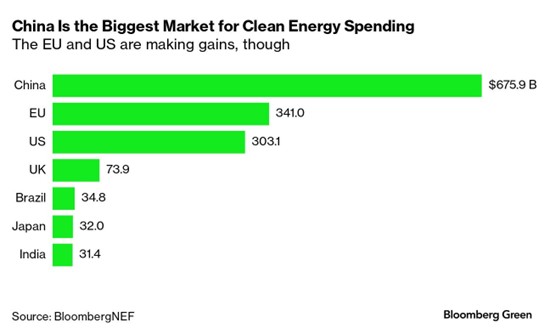

Stern spoke of a $2.4tn a year investment (ex-China) requirement to cut emission. The world is yet to deliver that, but the trend is hopeful. According to BloombergNEF, global spending on renewables jumped by 17% to $1.8tn in 2023. This figure included

investment in a range of technologies related to renewable energy, as well as the purchase of electric cars. This figure approaches $2.8tn, when financing and investment in the clean-energy supply chain is included. While China saw the highest level

of investment in absolute terms, the largest growth in investment was witnessed in the US, UK and Europe combined, with growth of roughly 22% to $718 bn, attributable to the Inflation Reduction Act in the US, EV sales in the UK and increased demand

for renewables in Europe following Russia’s invasion of Ukraine. As a rough calculation, and with obvious caveats, a 22% annualised growth rate would put that figure at $2.37tn by 2029, which would be in the ballpark of the annualised investment

highlighted by Lord Stern, albeit not as soon as he implied was necessary. In a notable development in the EV space, China’s BYD (“Build Your Dreams”) eclipsed Tesla in terms of sales of battery-only vehicle for the first time, with

the rivalry for global dominance heating up – although Europe’s investigation into subsidies might crimp BYD’s ambitions for that market, at least in the near term.

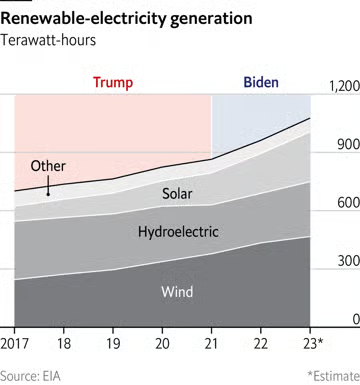

Growth in renewable energy capacity is accelerating

According to data from the International Energy Agency, global renewable energy capacity increased by 50% in 2023 to 510 gigawatts (GW) – yet another record growth rate. China once again stood out during the year, increasing wind power by 66% and

commissioning the same level of solar as adopted by the rest of the world in 202210.

Source: FT

We’ve highlighted the acceleration in investment above as a driver for this growth. However, an important green revolution tipping point can also be found in global policy dynamics, which have the potential to drive global competition in unexpected

ways. The Inflation Reduction Act, for example, has pushed the energy transition up a gear in the US, helping to build out a renewables value chain that challenges Europe, even if there have been challenges associated with cost inflation in areas

like offshore wind.

What is less well understood is the tacit globalisation of the European Emissions Trading Scheme (ETS) through the forthcoming introduction of the Carbon Border Adjustment Mechanism (CBAM), due to come into force in 2026. Aimed at avoiding carbon leakage

and creating a level playing field for EU industry against peers outside the ETS, the CBAM will force non-EU trade partners in relevant ETS industries subject to effectively participate in the permits system.

The FT11 has produced was some excellent analysis the potential virtuous knock-on effects this might have on the green revolution, including the potential for the adoption of similar border taxes elsewhere in the world (the UK has plans for

one), as well as China’s response, which have included more vigorous efforts to decarbonise some of its dirtiest industries (e.g. steel). China’s ability to move quickly could create an interesting feedback loop, whereby EU companies are

forced to reduce emissions more rapidly to compete. Additionally, China’s efforts to outcompete should also have domestic benefits potentially leading to a speedier decarbonisation of its economy. There are certainly many unknowns about how

this policy approach will play out, but the introduction of the EU CBAM could create an incentive framework currently lacking in the COP agreements. For investors, the carbon border taxes have the potential to put a clear price on the value of Scope

3 emissions, which would require consideration as part of stock-level analysis.

Biden v Trump and the road to renewable energy

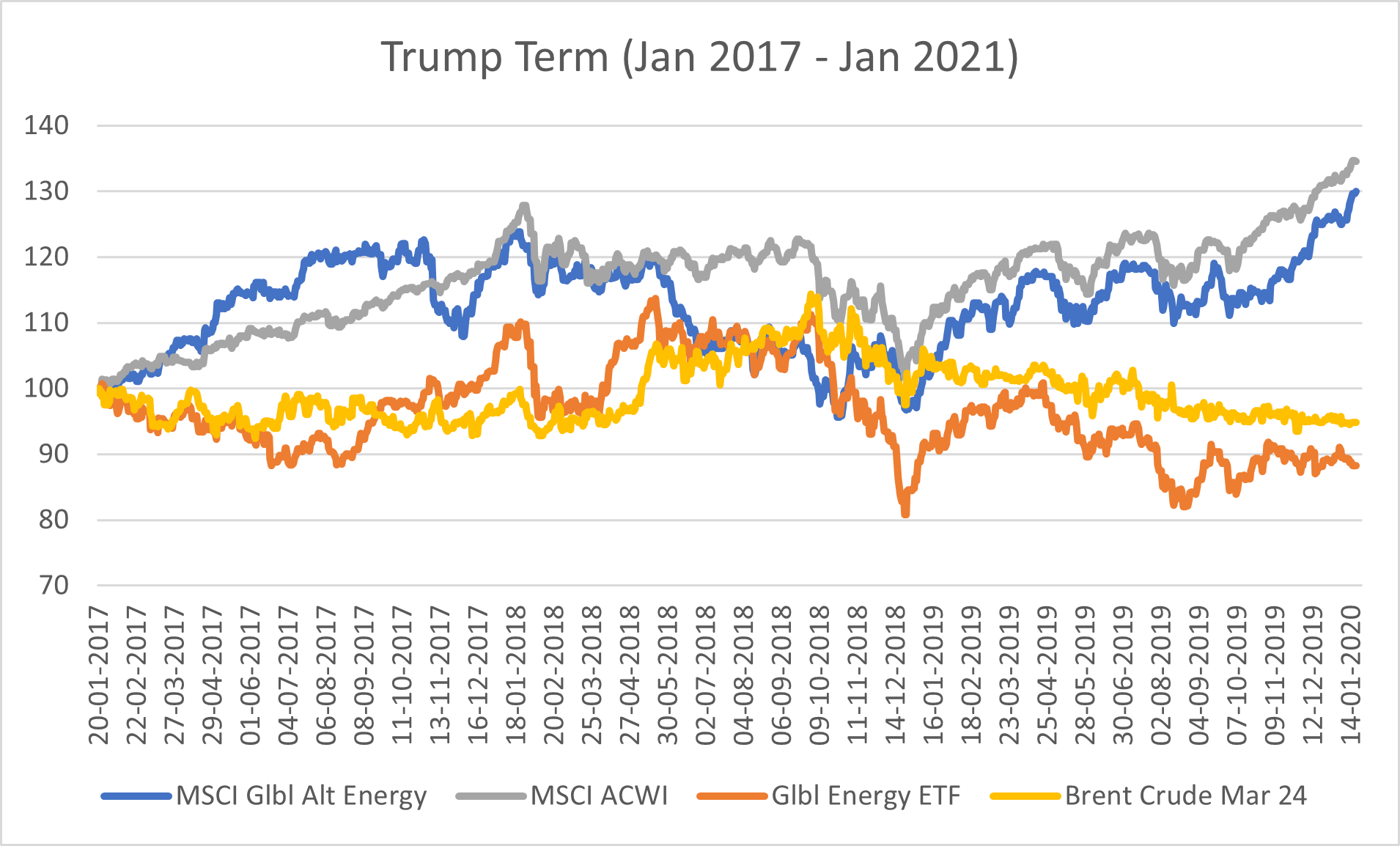

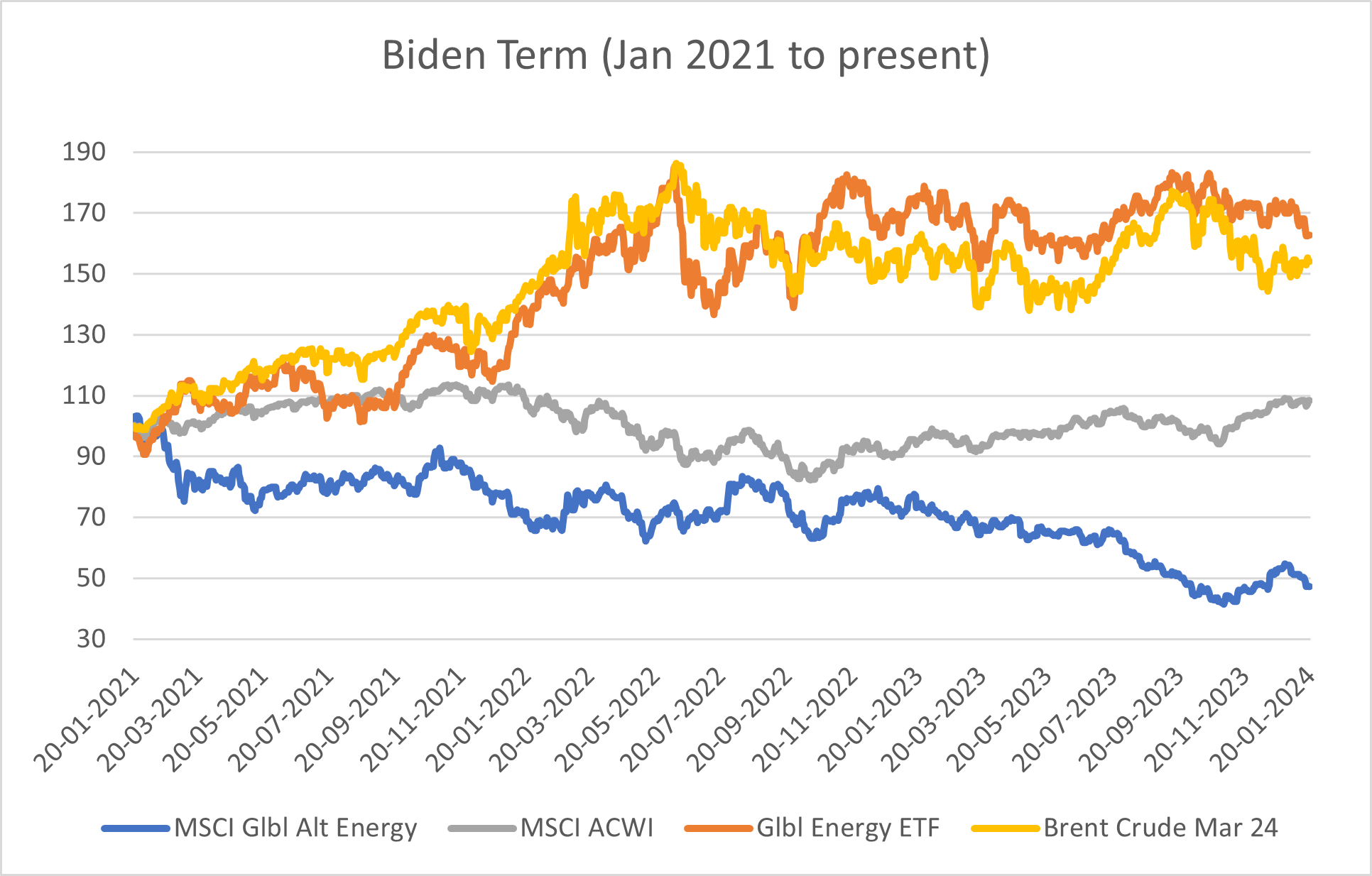

I’ll end this note with a few reflections on the forthcoming US election, which will be a pivotal event later this year. Of course, no body has a crystal ball with which to understand its impact. The battle lines are clear between the Republicans

(against) and Democrats (for) on climate policy and support for the clean energy transition. However, a few simple measures from their respective incumbencies suggests the reality will be far more complex than suggested by sparring rhetoric or the

risk of symbolic gestures such as pulling out of the Paris Agreement.

Starting with the Inflation Reduction Act (IRA), this flagship Biden policy has started to bear fruit and his administration has so far overseen greater deployment of renewables than Trump, although interestingly there was an acceleration in deployment rates

in the second half of Trump’s term. Intuitively, the IRA is something that Trump might be expected to pull back from. However, even if he could – most of the stimulus will already be allocated by then – it would be foolish to disrupt

progress given Republican states are generally the largest adopters of renewable energy in the US, with some 80% of IRA subsidies supporting clean technology in those states.

Source: The Economist

In terms of asset prices, Trump presided over a bull market for renewables and bear market for fossil fuels. Biden’s time in office has seen the opposite. What this shows is that the market’s behaviour has been driven by other factors, most

notably the interest rate and inflation backdrop during each president’s incumbency.

Source: Bloomberg, EdenTree

Central bank policy will remain a determinant of future market dynamics whoever wins in November – and in cases the reset has been healthy for renewables. As we’ve written before, the valuation-awareness that tends to run across our equity

portfolio has meant our funds have generally avoided the sort of volatility seen among some competitor funds in this investment area. One area we will be watching closely is how the next US president responds to the EU’s carbon border adjustment

mechanism, and whether it too might adopt a similar policy.

We plan to adopt SDR across our product range

It would be remiss of me not to mention the FCA’s SDR regulations. The team here at EdenTree are working tirelessly to adopt the new labelling regime across our entire fund range. Given our history as a purpose-driven responsible and sustainable

investment house, we are incredibly well positioned to adopt the regulations, not only at the product level, but at the entity level where we have a market leading stewardship and governance structure. As my colleague Carlota Esguevillas recently wrote, we look forward to adopting the regulations at the first opportunity, with our range taking on the Sustainability Impact, Sustainability Focus and Sustainability Mixed Goals labels as appropriate.

Thank you for your ongoing support.

Important information

The views contained herein are not to be taken as advice or recommendation to buy or sell any investment or interest. Please note that the value of an investment and the income from it can fall as well as rise as a result of market and currency fluctuations,

you may not get back the amount originally invested. Past performance is not necessarily a guide to future returns. EdenTree Investment Management Limited is authorised and regulated by the Financial Conduct Authority and is a member of the Investment

Association. Firm Reference Number 527473.

Sources