The EdenTree Green Future Fund might be two years young, but the strategy behind it marks its 20th anniversary this year. Co-Managers Charlie Thomas (CIO) and Tom Fitzgerald reflect on how the long game has informed the portfolio so far and discuss

what they aim for the strategy as it continues to bloom.

Key takeaways

- The Green Future Fund has performed strongly against similarly managed peer funds and in a way that is largely to be expected reflecting the team’s deep stock-level and thematic expertise in this area and patient “green at a reasonable

price” approach

- The Fund’s high active share1(99%), yet relatively moderate volatility compared to peer funds, speaks to the fact this is a stock-picking fund that covers the full breadth of its seven green themes, without the sort of factor risk

seen in some competitor funds or concentrated ETFs; its risk and return profile make it potentially a core strategy for green investors and an interesting proposition for mainstream or thematic global investors2

- Turnover has been low (c.13%), implying an average holding period of 7.7 years, which further highlights the depth of the team’s analysis and patient investment approach

- The UK-domiciled Fund is registered as “Article 9” in the Nordics and is planning to adopt the “Sustainability Impact” label in the UK

Mature heads on young shoulders

As in life, two years is not a long time in investing, especially for an investment you plan to hold for five or more years. Short-term sentiment and cyclical factors can often mask the inherent strengths of an underlying investment thesis. Successful

investing requires patience.

While the Green Future Fund is technically in its infancy, the strategy behind it reached its 20th year in 2023. In an investment context, this is a mature strategy, having been developed through our respective investment careers, with Charlie forging

the strategy in 2003, and Tom infusing the strategy with 10 years of global sustainable investing at EdenTree with particular strength in the disruptive innovation that is underpinning the transition. As co-managers, we seek to build consensus through

a process that challenges each other’s assumptions and draws on the expertise of EdenTree’s wider sustainable investment desk.

The headline message from the Fund’s first two years is that it has performed robustly against close peers3 and has only marginally underperformed the broad-based IA Global peer group. Indeed, it has performed as you might expect given

the market backdrop.

Figure 1: A performance profile that defies myths about green investing

Source: FE, net, bid-bid, GBP

That might seem a bold claim for a fund that produced a cumulative return of 4.4% in its first two years compared to 8.2% for the IA Global peer group and 13.0% for the MSCI ACWI index4. However, core headwinds to relative performance against

mainstream indices and index-focused funds have been largely a result of macro factors rather than stock selection or portfolio positioning decisions.

Given the strategy’s lifecycle focus on businesses with potential to grow and mature, it should not be a surprise that the Fund’s resulting small and mid-cap bias impeded relative returns, as it did for many funds with that orientation. Risk

appetite for these market segments was crimped by the steepest tightened cycle in the Federal Reserve’s history, with knock-on effects for US regional banks changed, with the collapse of Silicon Valley Bank particularly denting risk appetite

for smaller companies. Indeed, the Fund is well placed to benefit from both improved sentiment towards small and mid-cap stocks, as interest rates edge lower, as well as the potential longer-term tailwind of the small-cap premium.

Second, the period saw a vast chasm between the performance (and contribution) of the traditional energy sector to the market cap indices, on the one hand, and Fund’s investment in the alternative energy sector, on the other [see Figure 1]. This

was driven by a combination of rising interest rates, Russia’s abhorrent invasion of Ukraine and a general market retreat from ESG-related stocks.

Third, the Fund has no exposure to the Magnificent Seven, and tends to be structurally underweight the US (holding 49.4% of AUM versus 63.7% for the index at the end of the period) given the breadth of opportunities elsewhere. For this strategy, as will

many global strategies, it is difficult to justify the concentration risk associated with a benchmark weighting in the US.

The risk characteristics of the Fund are more closely aligned with the mainstream market than people might generally expect, highlighting careful management of factor risk (e.g. associated with companies sizes, valuations and underlying economic exposures)

and the strength of the proposition’s stock-picking and thematic characteristics.

Competitive returns from the transition to a greener economy

The Fund was launched in a year that was to become dominated by war (with associated impacts on commodity prices and inflation), rising interest rates and weakening sentiment towards ESG. Those early months were a time to be cautious, yet opportunistic.

We sought to make tactical use of the mispricing we witnessed in some areas of the market. This is a Fund for patient capital, and we are patient investors.

How we invest: the building blocks of a high conviction green solutions portfolio

When we established the Fund, we had a clear aim – to build upon a long-standing successful green equities strategy, which has been honed over 20 years and allocates capital to companies developing solutions to address the world’s most pressing

environmental challenges.

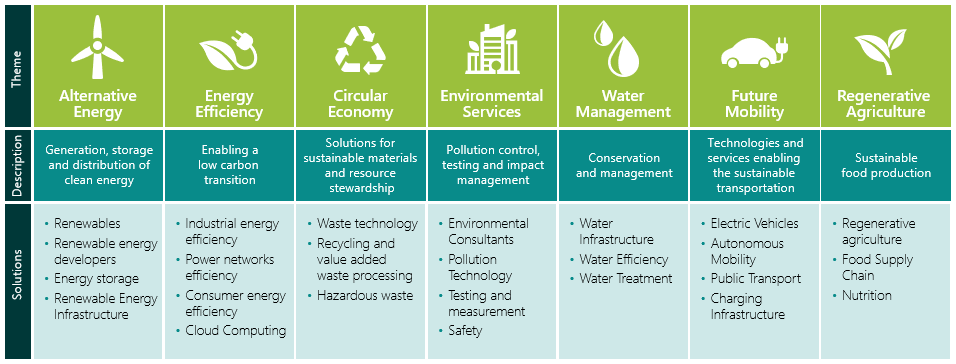

Although thematic by nature, Green Future is a bottom-up stock-picking fund, with a universe comprised of 1,500 stocks (and growing), focused around seven green themes: Alternative Energy, Energy Efficiency, Circular Economy, Environmental Services, Water

Management, Future Mobility and Regenerative Agriculture.

Figure 2: Themes for a Greener Future

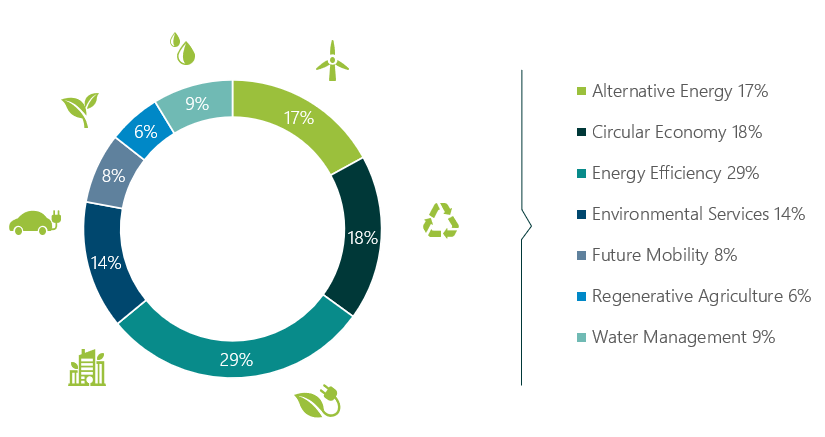

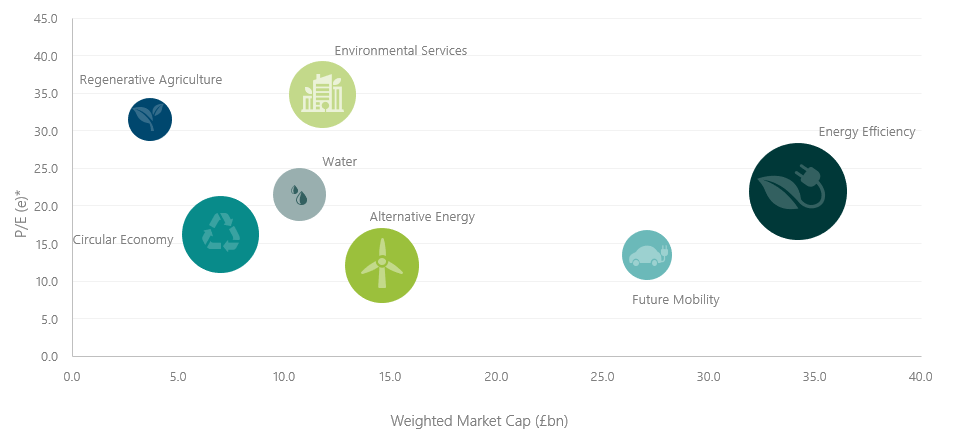

Figures 3 and 4 below speak to both the portfolio’s breadth across themes but also its risk and valuation characteristics. The portfolio is clearly diversified across all themes and, indeed, invests across market capitalisations. These charts also

highlight that the Fund isn’t just an alternative energy fund. Indeed, it currently has no exposure to wind turbine or solar panel manufacturers, where we believe investors are not being rewarded sufficiently for the risks associated with competitive

tensions in those marketplaces. We think there is opportunity and growth in wind and solar, but we don’t like the valuations on offer and prefer to gain exposure to this theme through companies on other parts of the supply chain – this

is one example of “green at a reasonable price” in practice.

The portfolio’s top five holdings alone highlight the diversification across themes, but also the depth of understanding we have of each company. Clean Harbors (Circular Economy), Schneider Electric (Energy Efficiency), Stantec (Environmental Services),

Brambles (Circular Economy) and Prysmian (Alternative Energy) are all 5+ year holdings in the broader strategy; some have featured in the strategy for over 10 years. This speaks to the depth of understanding we have in these companies, their competitive

advantage, the quality of their franchises, cashflows and management team and their ability to create value for investors.

Clean Harbors, for example, is a $9.5bn business with a strong economic moat. Oil recycling – some 230 million gallons per year in the US – is a unique part of this business and we believe the stock is an overlooked long-term opportunity.

Figure 3: Diversified across themes

Source: EdenTree 31.12.23

Figure 4: A blend of factor risks

Source: EdenTree 31.12.23

Green at a reasonable price

Our green at a reasonable price framework is founded on the general belief that the market inefficiently values the long-term potential of sustainable solutions companies, often underestimating the value creation potential of these solutions and the quality

of the businesses (including their economics moats) behind them. Our approach not only helps manage downside risk, but means our investors don’t pay a premium for access to the green revolution.

With three core elements, this approach is the bedrock that enables us to take a longer-term view of a stock and its potential within the wider market.

- Return profile: The market assumes that returns mean-revert over time, which often leads to high quality environmental solutions trading at a material discount to their intrinsic value

- Sustainability: By taking a long-term view and focusing on the sustainability of the environmental solution’s competitive advantage, we can exploit this inefficiency

- Growth: Companies with an established/improving competitive advantage can sustain/grow their returns longer than the market anticipates (but profitable companies)

It is an approach that has been developed over several market cycles and helps to inform what should be avoided as much as included (such as solar and wind manufactures, mentioned earlier, and indeed the solar sector leading up to and following the 2008-09

Global Financial Crisis).

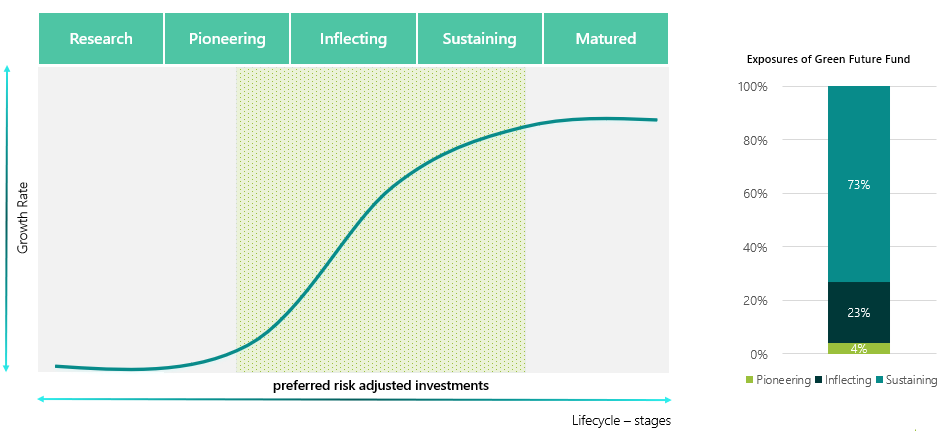

Lifecycle analysis sharpens the focus on proven solutions

Lifecycle analysis is an important part of our investment approach. In our experience, the best risk adjusted returns are often found in maturing, inflecting companies, as the market typically overlooks long-term opportunity associated with them. We particularly

focus on companies able to growth cashflows and that are profitable today, not at some distant point in the future. This helps build resilience in the portfolio.

Figure 5: A preference for inflecting

Source: EdenTree 31.12.23

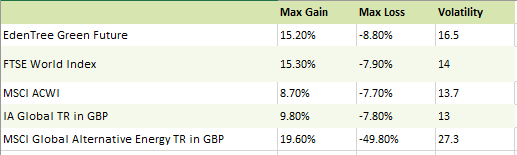

Stock-level conviction, avoiding unrewarded factor risk

Circling back to performance, the Fund’s green at a reasonable price approach, combined with lifecycle analysis and breadth of themes, creates a more competitive return profile against global indices than might be expected from a Fund with an active

share of 99%.As the table below shows, its volatility and gain and loss statistics have been far closer to those of mainstream indices than a specialist green index such as the MSCI Global Alternative Energy index.

Overall, this speaks to how carefully factor risk is contained within the portfolio, to enable idiosyncratic stock factors, which are backed by powerful thematic structural growth dynamics, to drive returns. This is truly a bottom-up stock-picking fund

rather than an alternative beta play. In our view, this makes the Fund an interesting proposition for sustainable and mainstream investors alike.

Source: FE, Period: 24.01.22-24.01.24

The road ahead

According to Met Office data, the global average temperature in 2023 was 1.46C above pre-industrial times, with each month in the second half of the year breaching temperature records. Although there were various factors at play, this is certainly a further

warning of the urgent need to address the causes of climate change and steer the economy toward greener, low-carbon solutions. While political policy and rhetoric has struggled to step up to this challenge, there remain powerful drivers behind the

green revolution from both the policy and economic fronts. Green subsidies have finally started to flow from the US Inflation Reduction Act (with some $385bn earmarked in total), the EU is pushing forward with more ambitions carbon reduction targets

and its Carbon Border Adjustment Mechanism, a new carbon tax that will impact trade partners from 2026, potentially helping to speed up the pace of decarbonisation in many parts of the world, including China. Indeed, China continues to dominate the

world in the adoption of renewable energy and development of EVs and could see a peak in its emissions sooner than forecast. Combined these factors are creating powerful competitive dynamics in the race towards a greener economy which are highly supportive

of the Fund’s thematic focus.

We are mindful, of course, of ongoing macro uncertainties, with geopolitical tensions currently at uncomfortable levels and the interest rate outlook still opaque, despite expectations that the US Federal Reserve will lower rates in 2024. However, we

hope that we have shown that we view short-term cyclical uncertainties as an opportunity to continue to apply our “green at a reasonable price approach”, which helps to minimise volatility through careful factor considerations, and sets

the Fund up to deliver positive long-term returns for patient capital. The Fund is well placed to benefit from an easing of interest rates, which should improve sentiment towards small and mid-cap companies, including those with thematic focus, and

capture the small cap premium over the long term.

As a final word, the Fund is UK-domiciled, with an “Article 9” registration in the Nordics. We plan to adopt the “Sustainability Impact” label in the UK, when the FCA’s SDR policy comes in, with the Fund’s theory of

change built around our core themes and the Fund’s impact coming from a combination of the solutions provided by underlying holdings and our wider investment team’s rigorous approach to engagement. This is very much a Fund that aims to

help drive the transition to a more sustainable global economy, while seeking to deliver competitive returns for investors.

Source: Morningstar. Figures compared on a Bid to Bid basis with Net Income Reinvested. The MSCI ACWI index was adopted as the Fund’s indicative benchmark on 1 January 2024, replacing the FTSE World TR index.

The main risks associated with this fund

Past performance should not be seen as a guide to future performance.

The value and income from the fund's assets will go down as well as up. This will cause the value of your investment to fall as well as rise. There is no guarantee that the fund will achieve its objective and you may get back less than you originally

invested.

Selecting stocks due to our ethical criteria means that the choice of stocks is limited to a subset of the stock market and this could lead to greater volatility.

Glossary

Active Share – is the measure of how a Fund differs from a benchmark index, with the higher the value the higher the difference (e.g. 100% represents no portfolio overlap with the index).

Article 9 – is a fund category under the EU’s Sustainable Finance Disclosures Regulation. It is the highest-ranking sustainable investment category under the EU’s regulation and refers to a “Fund that has sustainable investment

as its objective”.

Factor risk – refers to the underlying economic risks that drive the return of an asset (such as a stock), which might be related to the macroeconomic environment (for example, movements in interest rates) or risks associated with specific market

sectors.

IA – Investment Association

Lifecycle – a business lifecycle is often divided into stages, from the initial development phase to maturation. We analyse companies on a model that starts with research and move through the phases pioneering, inflecting sustaining, and matured.

Sustainability Impact – is one of four permissible sustainable investment fund labels under the UK Financial Conduct Authority’s (FCA) forthcoming Sustainability Disclosure Regulations (SDR) and investment labels policy due to come into force

on 31 July 2024.

Volatility – measures the fluctuation of the price of an asset over time.

Sources

- Please refer to the glossary at the end of this document for the explanations of technical term

- Based on EdenTree analysis using FE data of similar peer funds, based on metrics such as average volatility and drawdown information for the period from 24.01.22 to 24.01.24

- Based on EdenTree analysis using Morningstar data of similar peer funds for the period from 24.01.22 to 24.01.24

- Figures for 24/1/22 to 24/1/24; the adopted the MSCI ACWI as its indicative benchmark on 1 Jan 2024; its previous benchmark, the FTSE All World, produced a similar return over the two-year period.