A Just Transition in renewable energy: Our engagement with renewable energy investment trusts

The climate crisis cannot be averted without rapid expansion of the renewable energy industry. Indeed, estimates suggest that to reach net zero by 2050, annual clean energy investment worldwide will need to more than triple by 2030 to around $4 trillion.1

At the same time, it is crucial that the transition to renewables does not harm people, workers and communities. From concerns around forced labour in the solar supply chain and child labour in the sourcing of battery minerals, through to reports of indigenous rights violations in wind farms, the energy transition has the potential to cause significant negative impacts on human & labour rights. As companies deploy renewable technologies, they must consider the broader social impact of their operations and supply chain for the transition to be just.

Our engagement

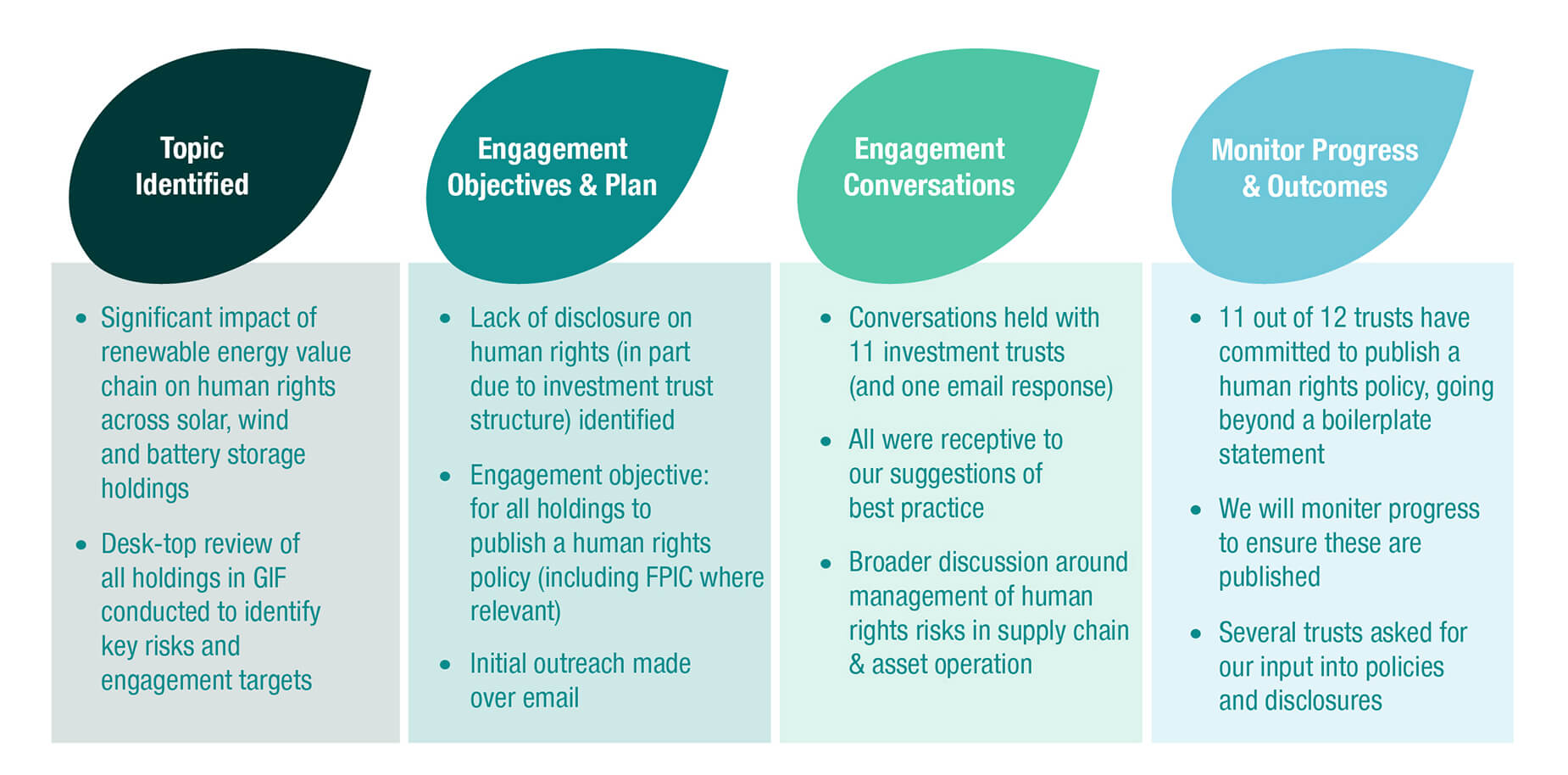

Against this backdrop, over the last six months we have been engaging with renewable energy investment trusts held in EdenTree’s Green Infrastructure Fund on the topic of human and labour rights. We targeted 12 companies in the fund’s universe, choosing to focus on investment trusts because of their potential adverse impacts on human rights and due to their unique corporate structure, which lends itself to less transparency in disclosures and investor scrutiny.

Our objective at the outset was for each organisation to publish a standalone human rights policy which addresses the specific risks they face, including a commitment to Free, Prior and Informed Consent (FPIC) where relevant. 2 Alongside this request we sought to better understand how each organisation was minimising the potential negative impacts of its activity, and using its influence to drive forward standards on human and labour rights. We held constructive conversations with 11 investment trusts and received one detailed response over email, and are pleased that 11 out of the 12 trusts we spoke to have signalled their commitment to publishing a human rights policy. Here we share our findings across the engagement.

Key themes

Indigenous rights & land use

Despite their explicitly positive contribution to decarbonisation, renewable energy assets are significantly more land intensive than traditional fossil fuels (although, to put this in perspective, golf courses make an even greater claim to land in the UK). Indeed, it is estimated that wind and onshore solar projects require about 10 times more land than fossil fuel projects to deliver the same power, placing significant pressure on local communities and indigenous populations globally.3 For our holdings with renewable assets located in or around indigenous communities - SDCL, Greencoat Renewables, US Solar4 and The Renewable Infrastructure Group (TRIG) - this was a key topic of conversation. Our focus was on encouraging the adoption of the FPIC principles.

Disappointingly, although perhaps unsurprisingly given the core UK focus of all these organisations, none of them had heard of FPIC. All, however, were able to evidence work done to deepen their understanding and recognition of indigenous rights.

For example, during our conversations, Greencoat Renewables and TRIG spoke of the importance of early engagement with the Sámi people when operating wind assets in Sweden. Both felt that financial arrangements alone were inadequate - a view we support - and favoured a holistic, in-depth and long-term engagement approach. Encouragingly, all four trusts for whom this topic was relevant committed to look further at FPIC and embed it into their policies.

Forced Labour

A topic which came up repeatedly in conversations around solar was the risk of forced labour entering supply chains, particularly given the Chinese province of Xinjiang’s dominance in the world’s production of polysilicon and the region’s alleged close ties with forced labour. Even when not directly sourcing from the region, trusts were rightly concerned that their supply chains may become “contaminated” with goods produced using forced labour.

Whilst the trusts were keen to stress the importance of engaging with suppliers rather than simply terminating contracts, they all mentioned a blacklist of companies which they would not work with due to near-certain links to the region. Beyond that, we heard that due diligence was key to being comfortable around traceability, and often required some creativity and perseverance. For instance, in addition to including no forced labour within contractual obligations, we heard of the importance of direct engagement with suppliers. This included conversations with CEOs, as well as in-person audits (both formal and informal). Despite sensitivities, in general it was felt that by asking the right questions and investing the time, trusts could “quickly gather who you wouldn’t want to engage [as a partner]”.

Although particularly pertinent in solar, forced labour was also identified as a risk in other industries including the battery supply chain. Harmony Energy Income Trust (HEIT) for example had identified it as a “key focus” and has included forced labour as a key engagement point as part of their supplier selection and monitoring process.

Partnerships and "collective leverage"

Given the systemic nature of many of these challenges, our holdings were keen to use their influence to drive change at a sector-wide level. Partnerships and collaborations were referenced as a key tool to exert “collective leverage” – something we very much advocate for. We heard of some interesting initiatives and were particularly inspired by the work Greencoat Renewables is leading with Solar Energy UK, which seeks to emulate the model which brought traceability to the gold value chain and implement it within the polysilicon supply chain.

It was also interesting to hear from Bluefield Solar that, following the US import ban on goods from the Xinjiang region, the EU bloc has growing influence in the Chinese solar market. For this reason, engagement as part of the European lobby group to set expectations around traceability was something several of our holdings were dedicating significant resource to.

Outside of solar, the importance of partnerships was further emphasised as we heard about the positive role played by the Fair Cobalt Alliance. The PRI was also credited with driving up standards in the sector, and both Gore Street Energy and Greencoat UK Wind spoke about the importance of collaborating with peers to share cross-sector learnings on topics such as health and safety, fire safety, and recyclability.

Labour Rights

Of the many risks that renewable assets face across the value chain, labour rights - and particularly health and safety - came up continuously in our conversations. From working with electrical currents, through to working at height and offshore, the risks are many and varied. As such, we were encouraged to hear of robust approaches to health & safety, with clear management buy-in.

For example, Greencoat UK Wind spoke of regular offshore safety drills and their rigorous approach to sharing near misses across the organisation. GCP Infrastructure highlighted the heighted risk associated with cleaning their biomass facility, which requires specialist contractors to move in confined spaces, and the additional training they provided to contractors to address this risk. The elevated risk arising from non-regular maintenance, cleaning and repair jobs was highlighted in several conversations, with mitigating action being taken across the board to ensure that all contractors acted in line with their safety standards.

Looking at labour rights more broadly, TRIG highlighted the importance of scrutiny across the value chain, in particular in higher-risk areas such as offshore vessels servicing their assets. Once more the need for due diligence to select the best partners came across strongly.

Governance

A final key theme across conversations was the need for buy-in across senior management, as well as the key role played by the Investment Manager in driving standards. Many of the trusts we spoke to have set up a dedciated ESG committe that were responsible for the overarching policy, with this then filtering down to the operational and asset level. HEIT felt this structure allowed ESG considerations to be embedded throughout the project life cycle, whilst Greencoat Renewables and Greencoat Wind spoke of the significant support and input they received from their investment manager’s sustainability team.

Across conversations, it was evident that more resource is being directed into the management of salient ESG issues and in improving ESG disclosures. Many organisations spoke of relationships with external consultants to support this work, and on several calls, we met recently appointed ESG Managers who had been hired to further accelerate work in this area.

Concluding remarks

Whilst not all the investment trusts have detailed human rights policies yet, we have been encouraged by our engagement. Although undoubtedly behind the wider corporate sector in terms of disclosure, our conversations have demonstrated robust due diligence processes and a genuine dedication to driving best practice in human rights. Most encouragingly, this commitment extends well beyond the operation of assets to include the oftenhigher risk area of sourcing and supply chains.

Our objective at the outset of this engagement was for our investment trust holdings to publish a stand-alone human rights policy outlining their approach to tackling salient issues, and we are pleased that all except one have signalled their commitment to developing and publicly disclosing a human rights policy. Indeed, following on from our meetings, several asked for our input on their human rights policy and broader sustainability disclosures.

A number also commented on the value that these in-depth conversations with investors have internally, in helping them to build the business case for action. We value this positive two-way dialogue, and it once again highlights the importance of engagement by investors. We will continue to engage constructively with investment trusts on the topic of human rights, and we hope that others will follow suit.

"Responsible and sustainable investing is all we do at EdenTree. It goes beyond screening and box-ticking. It's about thinking deeply about the ethical implications of our investments and engaging with prospective and existing holdings on the most important topics that arise from this process. This particular engagement campaign has been a case in point. In some cases, we were happy to find impressive depth of thought and strong actions taken. In other cases, we were able to witness first-hand initial dismissiveness giving way to dawning realisation.

We are able to do this at EdenTree because our Responsible Investment team lives and breathes for these sorts of engagements. It is a privilege as an investor to be able to work with them to integrate their insights into the investment process. We don’t simply assume that because our investments make a positive contribution to the energy transition they are ethical businesses. We look critically at their supply chains, their land use, their governance, and any other relevant topics before forming a view. By taking stewardship and engagement seriously in this way, not only does it reassure our investors that we are aligned with their values, but it also deepens our ability to collaborate with investee companies to achieve better outcomes. And, most importantly, it’s the right thing to do."

SOURCES

- Where is most biodiversity loss happening and why? | Royal Society

- Institute for Human Rights & Business, definition of FPIC, 2022: What is Free, Prior and Informed Consent (FPIC)? | Institute for Human Rights and Business (ihrb.org)

- https://www.brookings.edu/research/renewables-land-use-and-local-opposition-in-the-united-states/

- US Solar was in the process of being reviewed and divested prior to this engagement commencing. It was divested on financial grounds during the course of this engagement.