We are often asked by clients for our views on Gilts and how these ‘comply’ with our ethical and ESG screening process. In this RI Expert Brief we take a look at Gilts as an asset class and present our House view.

WHAT ARE GILTS?

‘Gilts’ is a generic term that refers to Bonds issued by the UK Government. They are generally viewed as a low-risk, secure asset class with often long maturity times.

Issued by HM Treasury, Gilts or ‘Gilt Edged Securities’ (originally the certificates were ‘gilt-edged’) are listed on the London Stock Exchange and come in two forms: Conventional and Index-linked.

Conventional Gilts are the simplest type of Government or Treasury debt and form 76% of the ‘book’. A Conventional Gilt guarantees to pay the holder a fixed-income payment every six months (the coupon) until the Gilt matures. These types of

Gilt are denoted by the coupon and maturity e.g. 1½% Treasury Gilt 2047. HM Government now tends to concentrate maturity dates around a 5, 10 or 30 year maturity timeframe.

Index-linked Gilts form the remaining 24% of Treasury debt and date from 1981. These Gilts have similar characteristics as Conventional Gilts, except they reflect actual rather than nominal borrowing rates, thus the coupon is variable in line with RPI

Index fluctuations.

Other types of Gilt have historically included floating-rate, doubledated conventional, and undated, however these types have now been largely withdrawn.

In November 2020, the Chancellor announced the government’s intention to issue an inaugural Green Gilt in 2021. The total green gilt issuance for 2021-22 will be in the order of £15 billion.

HOW MUCH IS CURRENTLY ISSUED IN GOVERNMENT GILTS?

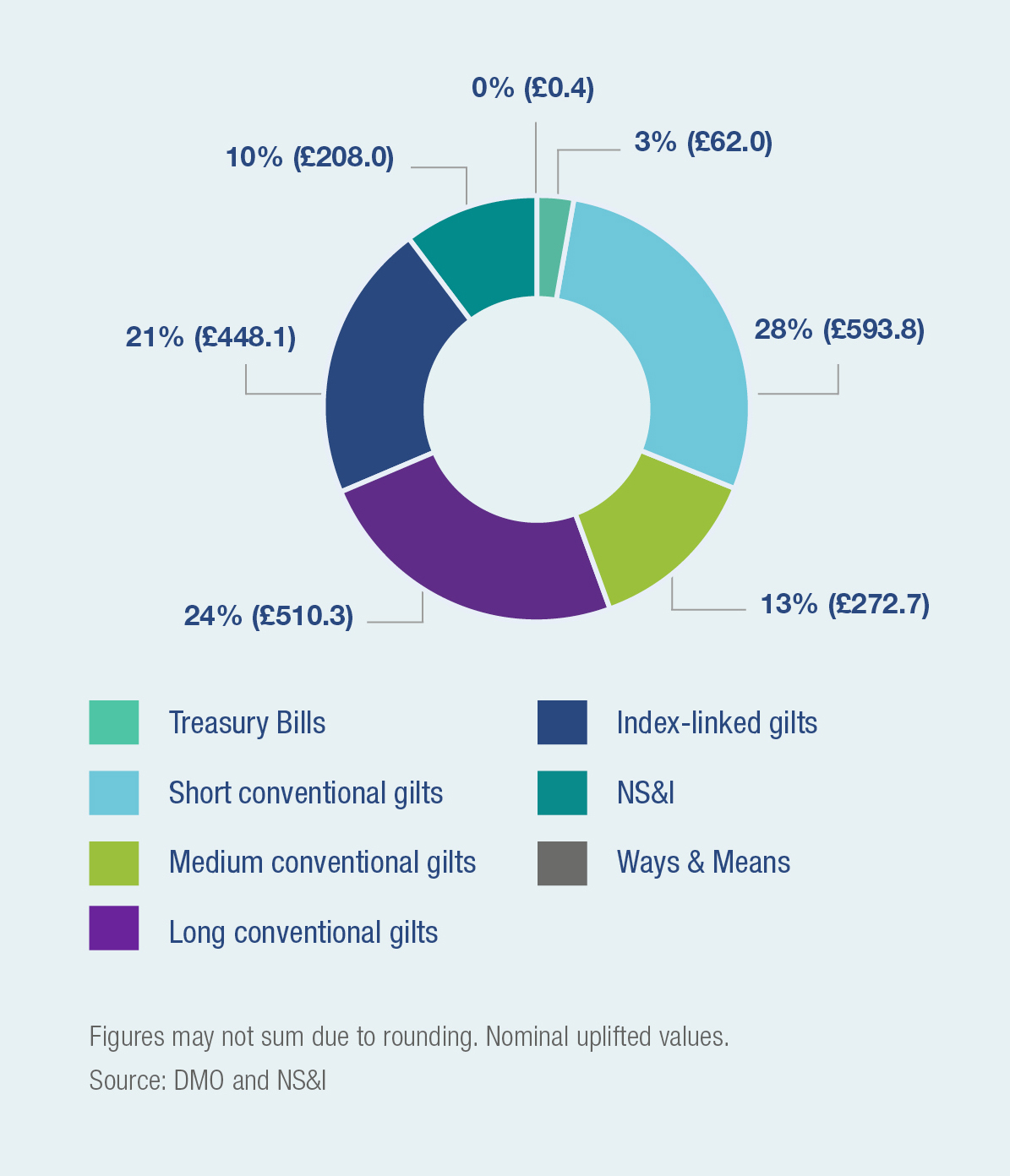

The UK’s stock of Index-linked Gilts stood at £448bn at the end of 2020, making up 24% of the total debt portfolio. This has fallen slightly on the historic average of 25%. The total Gilt portfolio at the end of 2018 was £1,886.9bn.1

WHAT ARE THE ETHICAL CONCERNS?

We view Gilts to be ethically acceptable; however, we are very aware that for some clients their place in an ethically screened fund is questionable. Responsible investors have by and large struggled to integrate ESG (environment, social and governance)

screens given one is dealing with Sovereign entities rather than investible companies. We integrate our screening process for corporate fixed-interest instruments via our Oppressive Regimes ethical screen, and we apply the same process to Sovereign

and supra-national issuing bodies, where we avoid investing if the territory in question is deemed ‘oppressive’ as judged by our proprietary screen. We have published an RI Expert Brief setting out how the Oppressive Regimes screen is

applied. Our published Expert Brief on this explains more, and is available here.

For some clients, the potential allocation of Gilt proceeds to areas of national expenditure such as defence or the nuclear programme make them ‘challenging’ investments.

There is a case under very strict criteria for avoiding Gilts on the basis that there may be some allocation to defence (although we cannot know this for sure). We do not draw this conclusion from an investment perspective as we support the democratic

process in which a political party (and subsequent Government) sets out its spending plans within a Manifesto for office. In a democracy such as the UK, taxation receipts and other public funding provision is not hypothecated; we cannot choose to

have taxes allocated to areas of public spending we prefer. One of the Government’s duties is to protect its citizens and all contribute to national self-defence via public funding in the same way as all contribute to funding the NHS or State

pensions.

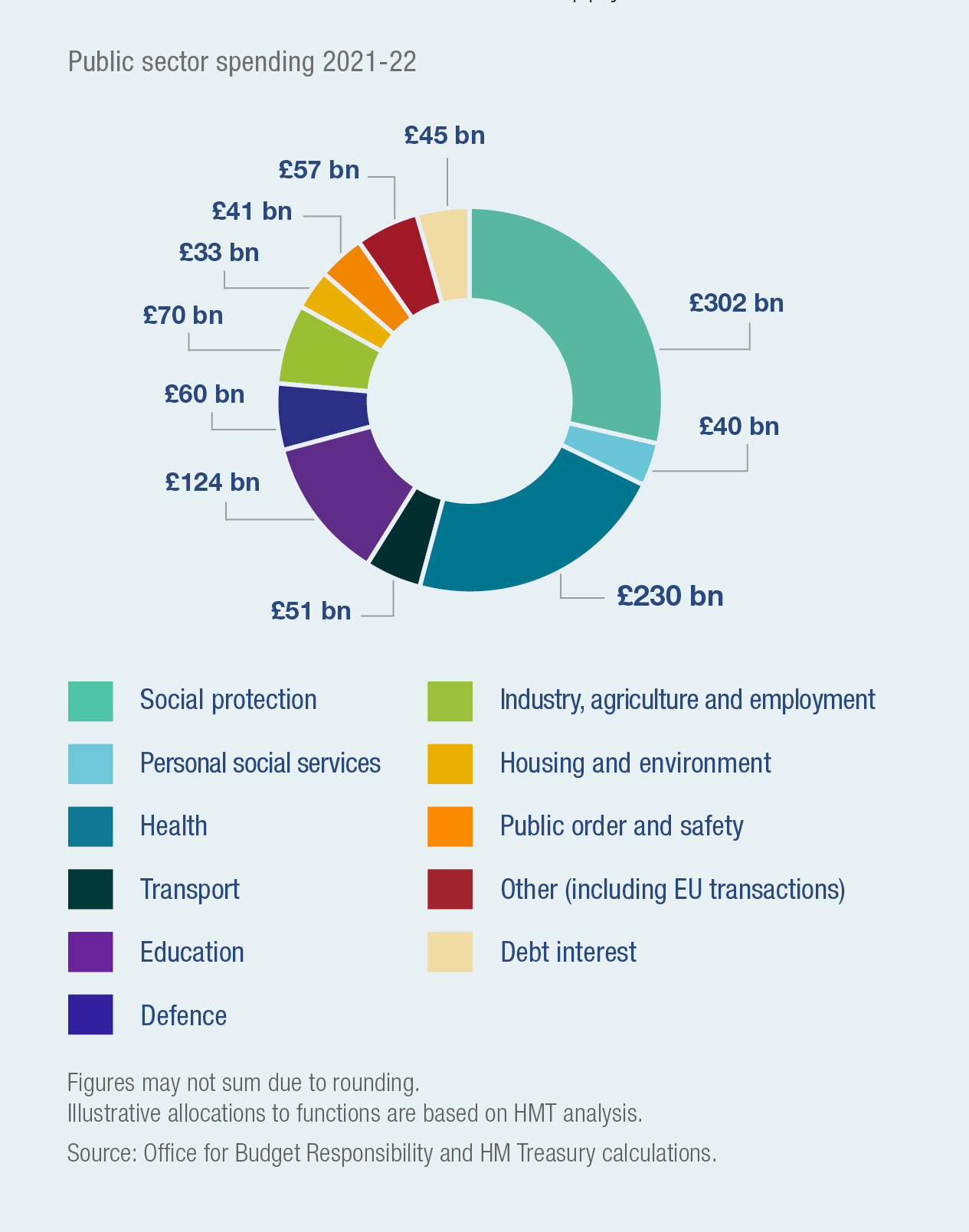

In the 2021 Budget Statement, the UK Government set out its total spending plans to be around £1,013bn in 2021/22.2 Of that, social protection, social services, health and education account for 69% - two-thirds – of Government spending.

Defence represents £60bn or 6% of national spending.3 This would fall comfortably below our ‘screened threshold’ of 10% were we to apply a screen.

WHAT ABOUT CLIMATE CHANGE RISK?

Gilts cannot be subjected to conventional foot printing in the same way as corporate bonds. The science around carbon and debt is maturing, but at present Gilts are excluded from any carbon footprint of our Funds.

WHAT IS EDENTREE’S POSITION?

We believe Gilts have a place in a balanced portfolio of fixed interest instruments where they provide surety of capital preservation and enhance fund liquidity over the medium to long-term. We are cognisant that for some clients Gilts may be less acceptable

given the potential for the proceeds being allocated to defence. However as a House we define Gilts as ‘ethically acceptable’ as an asset class.

Save for public-policy advocacy, we do not, as investors, have the same leverage to engage as we would routinely do with corporates. Moreover, we view the democratic process itself as sufficient for determining how best Government should allocate scarce

financial resources.

Investment exposure is fairly modest with UK Treasury Gilts held in only the Responsible & Sustainable Sterling Bond Fixed Interest Fund.

SOURCES

- HM Treasury Debt Management Report 2021-22

- HM Treasury Budget 2021 Policy Paper

- ibid