Funds in Focus

It's time to invest in change for better

Urgent steps are needed to address global sustainable development funding requirements, and governments have a unique ability to mobilise capital at scale through vast debt issuance programmes, placing them in a prime position to fund projects that tackle these societal challenges.

Sovereign ESG-labelled debt issuance is continuing at an unprecedented pace1, with government and or related issuance making up just over half2 of the outstanding global universe of use-of-proceeds green, social and sustainable debt.

In a market environment that offers considerably higher bond yields3 compared to the last decade, the risk-return profile4 of government debt from an asset allocation perspective has markedly improved.

[1] Environmental Finance – Sustainable Bonds Insight 2024 -Breakdown of issuer type

[2] Governments’ sector made up 56% of iBoxx Global Green, Social, Sustainability Index as at 31st July 2024

[3] Bloomberg Barclays Global Agg. Treasuries Index yield back to approximate pre-2008 average of 3.1% vs post-2008 average of 1.6%

[4] Bloomberg, showing weighted average duration of index and the yield of the index over time as at 25/10/2024

Sustainability through Government Bonds

Financial Objective

To generate a regular income payable quarterly with some capital growth over a period of five years or more through investment in a portfolio of government and government-related green, social, sustainable or

impact bonds.

Sustainability Objective

To invest in government and government-related green, social, sustainable or impact bonds whose proceeds will be used to finance new or existing projects that support a reduction in the level of carbon emissions caused by human activities (measured in tonnes of carbon dioxide equivalent CO2 avoided), and/or to enable greater access to basic social services (measured in number of beneficiaries).

Further information on the Fund’s Investment Objectives, Policy and Sustainability Approach can be found in the Prospectus, Sustainability Disclosure and Key Investor Information Document. All are available via our Literature page.

The value of an investment and the income from it can fall as well as rise as a result of market and currency fluctuations, you may not get back the amount you originally invested.

Investing for a better tomorrow

- The Global Sustainable Government Bond Fund has adopted the Sustainability Focus label. We are delighted to have met the high standard required to add the new fund label under SDR. We believe the new regime represents a positive step forward for the industry - one that will build trust in the sustainable investment market and help combat greenwashing.

- As a firm with a broad range of differentiated responsible and sustainable solutions, we recognise the important role we must play in improving transparency and investor understanding in this important area of the market.

EdenTree’s Global Sustainable Government Bond Fund – our unique solution to the market

Launch Date

28/10/2024

IA Sectors

Global Government Bond

Related content

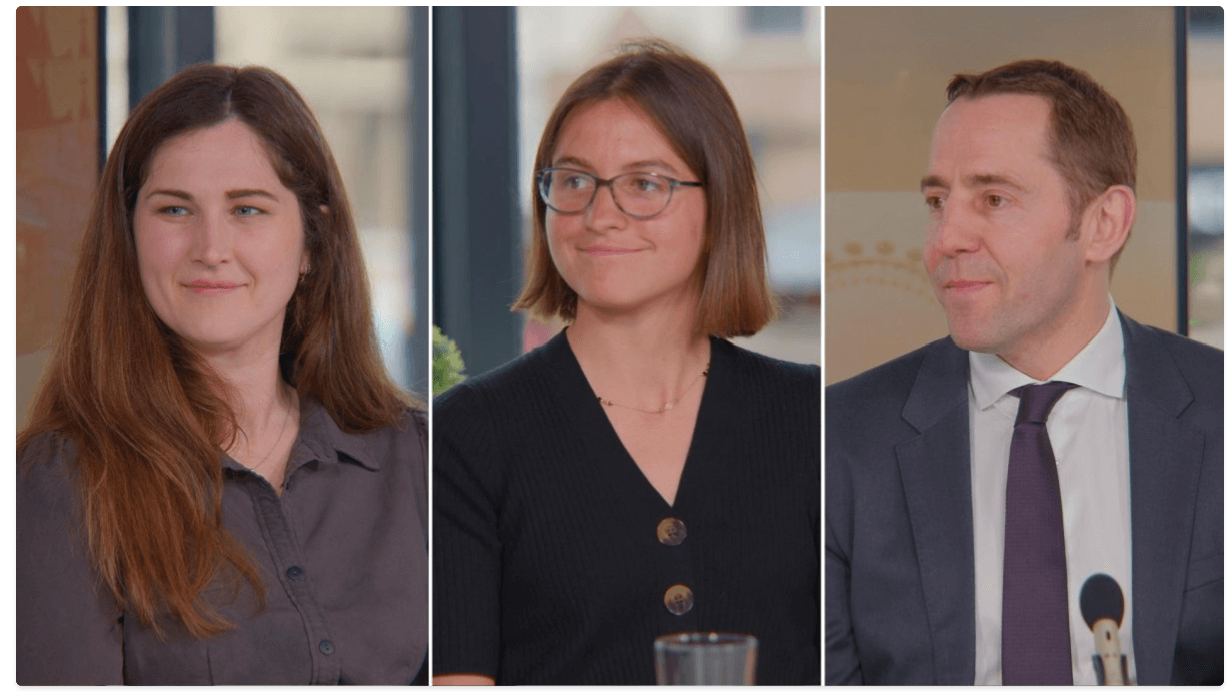

Fund manager

David Katimbo-Mugwanya

Head of Fixed Income

David, as Head of Fixed Income, leads on EdenTree’s Sterling Bond and the Short-Dated Bond funds, the Global Sustainable Government Bond Fund and also co-manages the Global Impact Bond Fund. David joined EdenTree in 2015 and possesses

close to two decades’ investment expertise within the asset class across sovereigns, corporate debt and money markets portfolios via designated mandates as well as bespoke investment solutions.

David is a CFA Charterholder, holds

the Investment Management Certificate (IMC) and a BSc. Economics degree from the University of Essex. David is also a member of the London Stock Exchange’s Primary Markets Group, an advisory group to the LSE on matters relating to primary capital

markets.