As responsible, sustainable and impact investors, engagement with companies is one of the most important aspects of our work and one which can result in the most profound real-world impacts. In the past three decades of engaging with companies in our

portfolios, it has proved a powerful way of improving investee companies’ performance on a range of environmental, social and governance topics.

To achieve the best outcomes for our clients, we look to focus our time and attention on issues that are most material to our investments, and where engagement can have the greatest impact on environmental and social outcomes. We believe that the way

we engage with businesses enables us to make sound, responsible investment decisions and to act as a force for change.

For more information on how we engage – including our approach to capturing outcomes and escalating our engagement – please refer to our How We Engage document, available here.

Our priority engagement themes

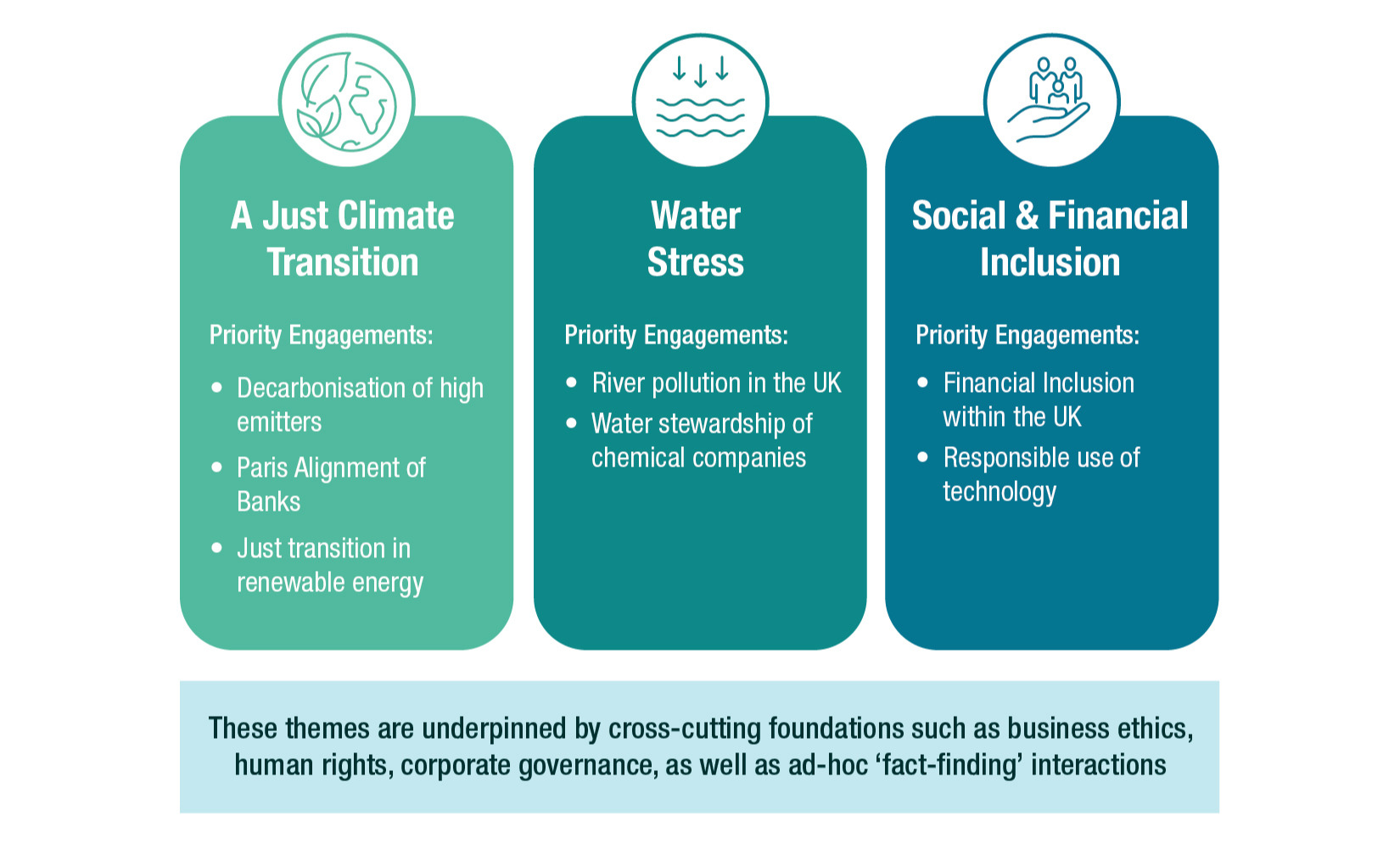

Each year, we review our thematic engagement priorities and highlight our core areas of focus. These thematic priorities are those which we deem to be material to the long-term value of our investments, and where we believe we can drive real-world change.

They tend to run for several years, recognising that engagement is long-term and change takes time. Based on this process, we have identified three broad themes for our engagement, shown below:

As an active asset manager, many of our company engagement meetings are conducted on a one-to-one basis. However, each of these areas present large, complex problems to address and we cannot solve these issues alone. We therefore seek to collaborate other

investors and stakeholders where partnering will help us exert greater influence.

Just Climate Transition

The science of climate change is unequivocal; we are already living in a climate emergency and must rapidly reduce greenhouse gas emissions. To achieve the Paris Goal of limiting global warming to 1.5°C, CO₂ emissions must fall by 45% by 2030, reaching

net zero by 2050.

We have a responsibility to encourage our investee holdings to reduce their emissions and implement robust climate strategies. As such, climate change is the first of our thematic engagement priorities.

A key focus will be on engaging with the heaviest emitters in our Funds via our Climate Stewardship Plan. The Plan covers c.70% of EdenTree’s scope 1&2 financed emissions, and monitors company performance against a series of best practice indicators.

Cognisant that scope 3 emissions are equally important, another focus under our climate pillar is engaging with Banks to encourage withdrawal from projects that are misaligned with the Paris Agreement goals. This will be done both unilaterally and

collaboratively, as members of the Institutional Investor Group on Climate Change (IIGCC).

We believe that climate is not simply an ‘environmental’ topic; it will also have profound societal impacts. With this in mind, we aim to capture the social impacts of the transition within our conversations on climate. A particular focus

will be on ‘transitioning in’ assets – i.e., our renewable energy infrastructure holdings – and how they can maintain a high standard of human rights whilst continuing to provide the low-carbon energy we need for a successful

transition.

Finally, we recognise we cannot drive the transition alone. We will therefore support our work through involvement in a number of collaborations, including Climate Action 100+, the CDP, ShareAction, and the IIGCC. These forums will also be an avenue for

policy-related engagement.

Water Stress

Billions of people around the world already face some form of water stress, and the problem is only expected to get worse due to global warming and population growth. By 2025, half the world’s population could be living in areas facing water scarcity1,

and by 2030, a 40% shortfall in the global freshwater supply is expected2. It is also a systemic financial risk as the global economy depends heavily on water, and its growing scarcity may lead to lower production capacity, stranded assets,

and increased credit and insurance risk.

Therefore, we believe that promoting effective water stewardship brings not only social and environmental benefits but is also a means for companies to preserve shareholder value. We also intend to utilise this engagement theme as a channel for our work

on biodiversity. Nature is a topic of immense complexity, and we believe targeting a particular aspect, in this case water, will allow us to focus our engagements and drive more meaningful change.

We will continue our engagement on river pollution with our water utility holdings, to keep them accountable and push for best practice. We intend to focus on policy work in 2024, which is particularly pertinent given the PR24 Ofwat price review, and

our aim is to ensure that the regulatory framework is fit for purpose and supportive of positive environmental outcomes.

Looking at water stress through issues of quality and quantity is something we are addressing in our chemical company water engagement. It is a long-term thematic engagement focusing on chemical companies’ water use in production, management of

wastewater, chemical afterlife and phase out of hazardous chemicals which contaminate water ways harming the environment and human health.

In addition, to support this work we are active members of the Investor Initiative on Hazardous Chemicals, the Valuing Water Finance Initiative and the Investor Action on Antimicrobial Resistance (AMR). These collaborative initiatives will enable us to

push for best practice on hazardous chemicals, high water stress, and AMR, thereby supporting our broader objectives.

Social & Financial inclusion

Inequality in income and wealth has been increasing for the past 40 years, but the Covid-19 pandemic and the cost-of-living crisis have thrown into sharp focus these levels of inequality in the UK. Inequality is a systemic risk: it undermines social cohesion,

erodes trust in institutions and fuels unrest3. When we reduce inequality, everyone – including the companies we invest in – are better off.

For this reason, social & financial inclusion is our final thematic priority, and our focus initially is on financial inclusion. Financial products are essential for full participation in society, yet an estimated one in four adults in the UK will

experience financial exclusion at least once in their lives, many being denied access to credit and other basic services4. With this in mind, we are planning to conduct an engagement with our holdings across the financial services sector

in the UK - with a focus on access to basic banking services and affordable credit for the un- or under-banked. Among the other topics we hope to explore is the impact on financial inclusion from bank branch closures in the UK.

Alongside this, we will continue our involvement in several collaborative initiatives with a broader focus on social inclusion. This includes working with the World Benchmarking Alliance on responsible use of technology, participating in the 30% Club’s

Ethnic Diversity working group, and supporting the Votes Against Slavery initiative on modern slavery.

For updates on our engagement work throughout the year, look out for our quarterly RI Activity Reports on our website!

Sources

- Water scarcity | UNICEF

- Freshwater demand will exceed supply 40% by 2030, say experts | World Economic Forum

- Responsible investors can help businesses tackle inequality

- Keeping pace with rising costs – improving financial inclusion for consumers